Fireside Chat with Mary C. Daly

Watch President Daly’s conversation at the Stanford Institute for Economic Policy Research (SIEPR) Associates Meeting.

April 15, 2024

The Latest

What We Study:

Insights, research, and data on various topics affecting our economy.

News & Media

The San Francisco Fed chief says Silicon Valley is thriving, but “in transitional waters” on Marketplace Tech

March 7, 2024

Bloomberg Television’s Wall Street Week: Fed’s Daly Says Policymakers Track a Dashboard of Indicators on Inflation

March 6, 2024

Fed’s Daly Warns It Would Be ‘Premature’ to Think Rate Cuts Are Around the Corner on Fox Business

January 19, 2024

Help our country reach its full economic potential.

Meet the SF Fed

Learn more about our groups and their work in pursuit of the SF Fed’s mission.

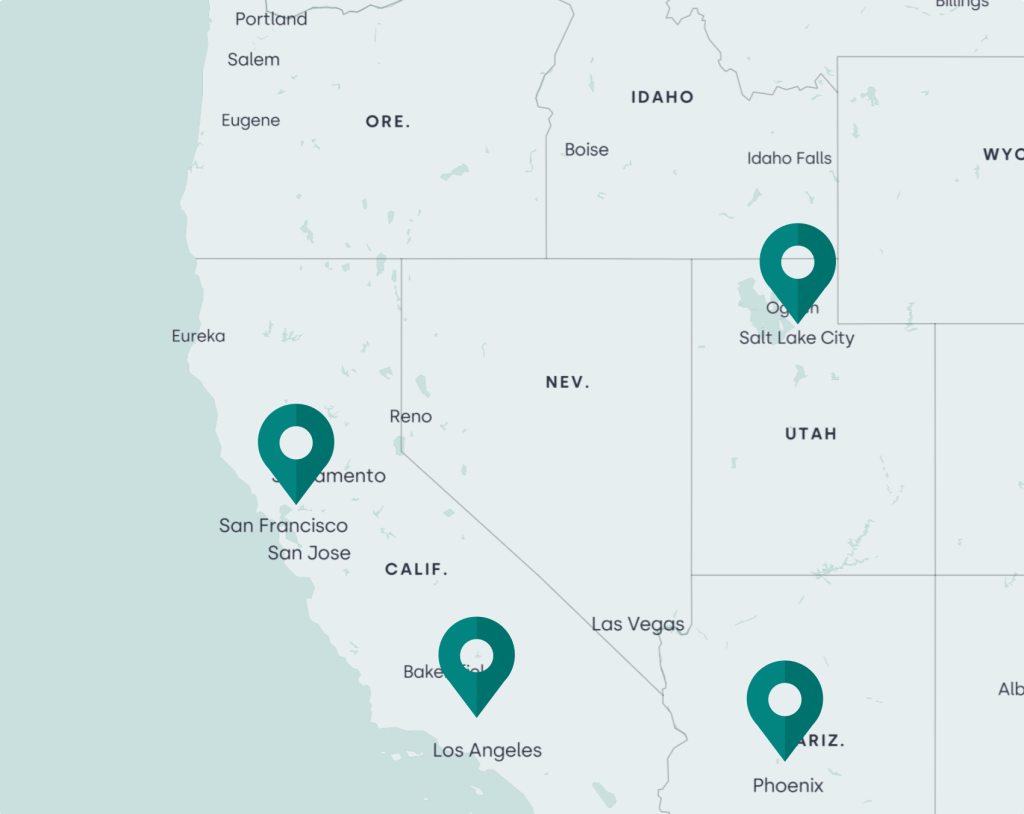

Around the District

Video & Media

Watch the latest videos from the SF Fed covering events and topics relevant to the Twelfth District and beyond.

Explore the 12th District

The Federal Reserve Bank of San Francisco is one of the 12 Reserve Banks in the Federal Reserve System. San Francisco is the headquarters of the Twelfth Federal Reserve District.